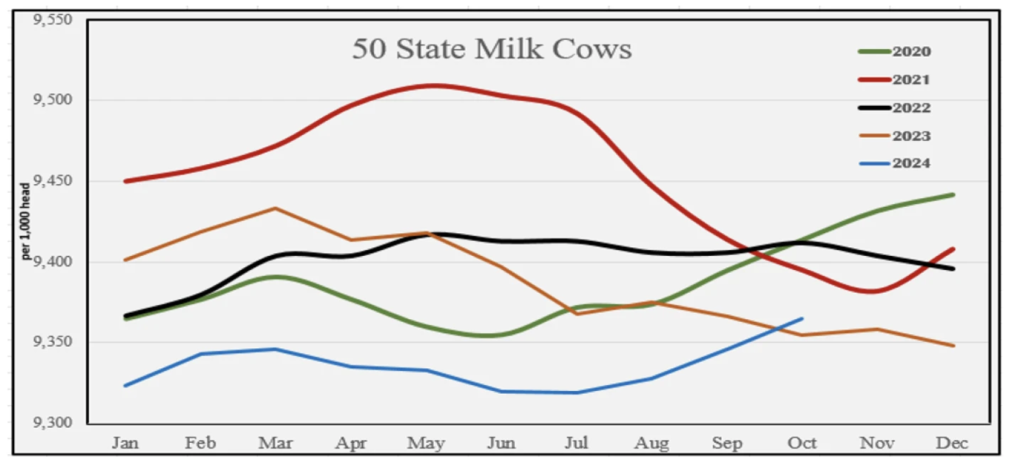

Cow numbers in October were higher than in the previous year. This is the first time cow numbers exceeded year-earlier levels since May 2023. Even though there is a tight heifer supply, more cows are being added to the nation’s herd

Class III futures had a little reprieve last week from the steady decline seen since mid-October, but that was short-lived as it was only temporary. Spot butter and cheese prices continue to struggle as supply remains sufficient for demand, leaving buyers complacent. Demand for the holidays has not been as expected and the inability of prices to find support at this point does not bode well for the market.

The price increase that took place last week in spot cheese and the strong reaction by Class III futures ended with the release of the October Milk Production report. That may not have been the only reason the strength of the market ran its course, but it did influence the weakness. Even though the milk produced in October had been processed, stored, or consumed, the report showed little reason for buyers to be aggressive as supplies should remain readily available for the foreseeable future.

Milk production exceeded the previous year for the third consecutive month. This was mostly due to increasing production per cow. Since November 2023, only May and June showed milk production per cow below the previous year. Even with reduced culling leaving older and less productive cows in the nation’s herd, increased milk output was achieved. What is more surprising is that cow numbers in October were higher than in the previous year. This is the first time cow numbers exceeded year-earlier levels since May 2023. The jump of 19,000 more cows in October than September was a surprise. This pushed cow numbers to 9.365 million head.

The increase in cow numbers and production keeps buyers comfortable with the current supply of dairy products. The October Cold Storage report showed cheese inventory remaining below a year ago, but that is not causing concern for buyers. They see sufficient supply through the end of the year and the potential for increasing milk production. The bearish category of cold storage was butter. It had a seasonal decrease in inventory but remained 11% above a year ago. This continues to keep pressure on the market. Butter futures set a new low for the year on November 25th with the price falling back to mid-December

The heifer supply has been tight and expensive, but that has not had a significant impact on the nation’s herd or milk production. There have been reports of dairy operations expanding or planning to expand. One cheese plant in my area purchased a facility that had been empty for a few years and is currently remodeling and increasing the size of the plant. This company is not increasing its production capacity to obtain new patrons, but to allow for the expansion desires of the patrons they already have. It is the nature of the business, and this desire will continue as long as farms can cash flow and hopefully build equity. To some, expansion is a matter of necessity. Along with that comes the necessity to manage the risk of feed and milk price fluctuations.

If you want share any News related Agriculture with us than send at info@agrimoon.com with your contact detail.