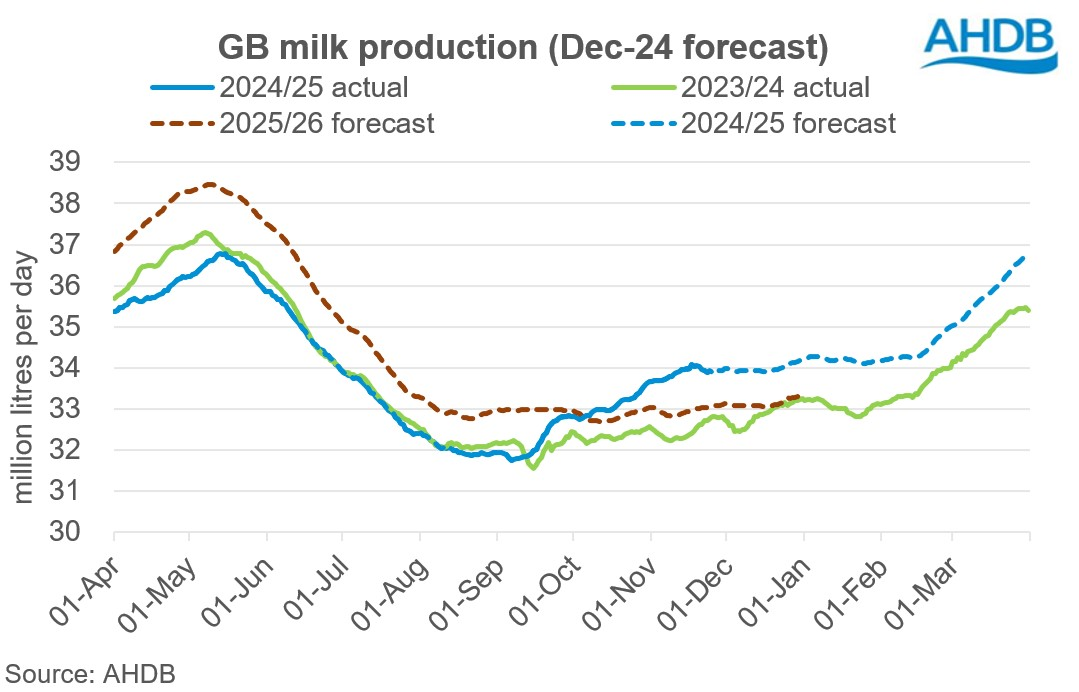

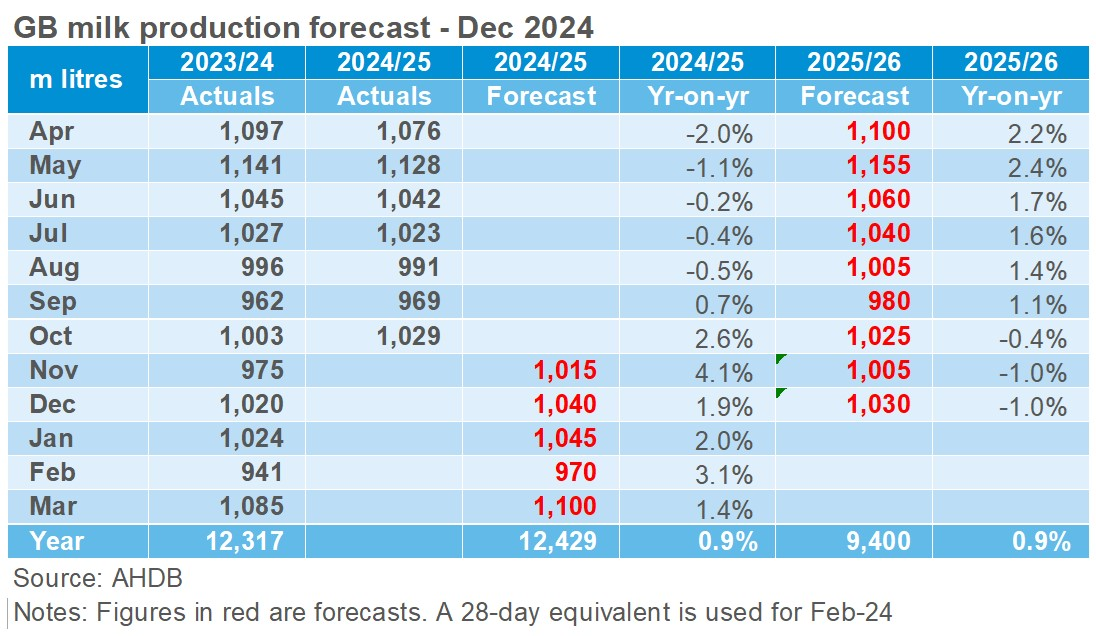

GB milk production for the 2024/25 season is forecast to reach 12.43 bn litres, 0.9% more than the previous milk year, according to our December forecast update

This milk year has been divided into two halves, with the first half lagging behind last year’s production, driven by wet weather conditions during the spring season and the preceding Autumn and Winter months and lower prices. This led to lower yields in the first half with lower levels of forage availability keeping production behind last year. However, the situation turned in September. Higher milk prices and improving margins, along with good grass growth (varied in regions) and much dryer weather that allowed the cows to stay out for longer brought a resurgence in milk flows.

A combination of both bullish and bearish factors comes into play around this forecast. GB milk deliveries in September and October were up by 0.7% and 2.6% respectively compared to the previous year. We are now annualising against a year of lower milk deliveries following poor weather. So far, November looks extremely buoyant with milk volumes up by nearly 4.5% in the month-to-date.

Challenges ease

Milk prices remain elevated compared to last year, the average Defra price sat at 43.06ppl for Sep 24, an increase of 18% year-on-year. Commodity markets have been very strong, with butter and bulk cream breaking records this Autumn. With shortages of stocks on fats this should support prices in the coming months. The expectations for the rest of the milk year are that now with a continuation of the firm tone in prices, farmers will be incentivised to produce more. The boom in autumn calvings and positive price announcements in November also supports this.

From next April, we expect milk prices to begin to normalise in response to the growth in milk production. Towards the back end of the next year, production is likely to be more subdued comparing to the record highs this year.

In general, inflation in key input costs has eased recently, although they still remain at historical highs. In July, the overall API for all agricultural inputs was the lowest it has been since December 2021. The easing of key input costs is likely to improve farmer’s confidence and support them in scaling up production. Feed costs in particular have come down to much more reasonable levels. The average feed wheat prices have declined 0.7% to £181.40/tonne in Sep24 and average concentrate prices have declined 11% to £301/tonne in Aug24 year-on-year.

The milk to feed price ratio is looking very favourable towards expansion in production going ahead. Wet weather through the growing season has affected the silage quality for some which could present an issue as the winter progresses. However, the upside in milk prices movement will provide room for the farmers to supplement with extra feed during the winter months.

Moving ahead

Despite the bullish factors, there are always uncertainties surrounding the sector and the path ahead is not without obstacles. Improvements in demand and tight supplies are helping to support the market currently but this could change as more milk hits processors.

The extent of this recovery is also dependant on other significant structural and policy changes across the industry. The inheritance tax announced in the recent budget could dampen farmer confidence, and certainly be damaging to morale. Increased environmental regulations will also have an impact. Access to cheap credit has been curtailed with interest rates sitting much higher than in the preceding decade. Disease outbreaks such as TB and BTV3 also offer a potential risk to the forecast. BTV, in particular, is causing impacts on milk production in affected regions such as Germany and the Netherlands. This could impact the UK next year as midge season gets underway. Conflict in the Middle-East, China/EU tariff-wars and the newly formed government in the US could also produce additional trade frictions and dampen demand.

Higher commodity prices will begin to feed through to consumers which could put a brake on demand in UK retail at the same time as an oversupply of milk comes into play. This has the potential to put a negative spin on milk prices next year. The industry may need to ensure they are prepared for such an eventuality if that was to play out.

If you want share any News related Agriculture with us than send at info@agrimoon.com with your contact detail.