As global inflation and GDP growth rates decline, the dairy products and alternatives industry expects low value growth in 2024, although the forecast period looks more promising.

In this context, private label is expanding as consumers prioritise affordability, and dairy products are increasingly being integrated into fast-growing snacking occasions driven by busy lifestyles.

Additionally, with consumers seeking health benefits and valuing sustainability, the plant-based segment continues to grow.

Consumers seek health benefits

Euromonitor’s Voice of the Consumer: Lifestyles Survey, fielded January to February 2024, reveals that 54% of global consumers look for healthy ingredients in the foods they buy. The top 10 claims in dairy products and alternatives globally are illustrative of the main health benefits that the industry offers; for example, probiotic content in yoghurt and sour milk products linked to digestive and immune health. In this context, manufacturers are expanding their kefir lines with new consistencies, packaging options and flavours

Chart showing Top 10 Claims in Dairy Products and Alternatives, World 2023

Consumers are seeking both physical and mental health benefits, with increasing functionality across all categories, even in indulgent products.

Dairy products grow in snacking occasions

Two thirds of consumers globally are looking for ways to simplify their lives, and the percentage willing to spend money to save time rose from 42.0% in 2023 to 49.5% in 2024

With busier lifestyles, dairy products that offer on-the-go consumption or quick meal solutions are thriving. As consumers spend more time outside the home, since the frequency of in-person workdays is increasing for many employees, products like yoghurt sticks, drinkable dairy, and cheese are becoming popular for active consumers seeking healthy snack options.

Plant-based dairy continues to expand

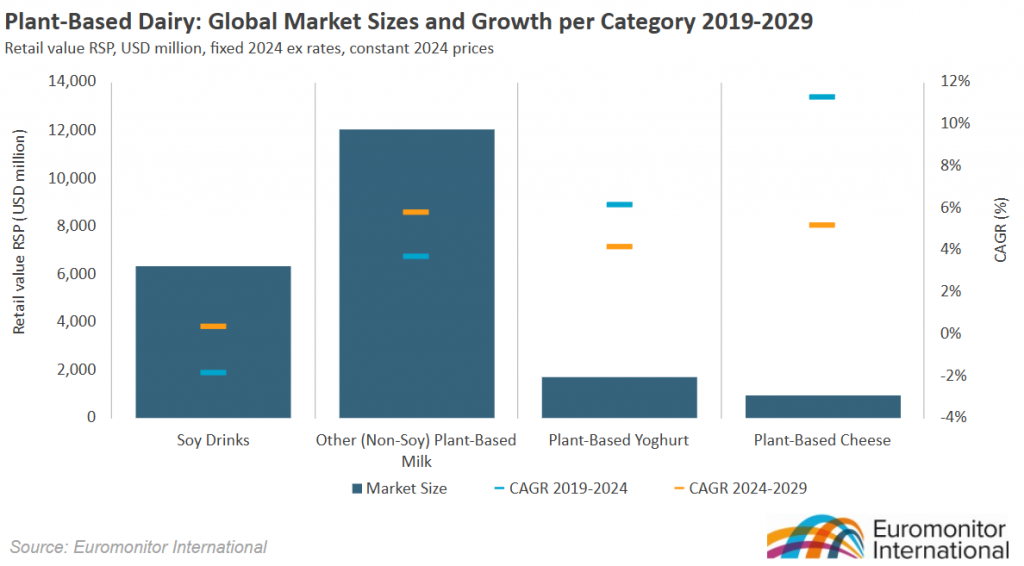

Health, environmental concerns and animal welfare are the key drivers behind the growth of plant-based dairy. The global value CAGR over the forecast period (2024-2029) of 4.1% is expected to exceed the historic value CAGR (2019-2024) of 2.3%. The increasing portfolio, sophistication and functionality of plant-based products are supporting this growth.

Chart showing Plant-Based Dairy: Global Market Sizes and Growth per Category 2019-2029

High protein content is expected to make plant-based products more competitive with animal-based variants, and more attractive for vegan and vegetarian consumers. However, the industry still faces challenges in reducing preservatives and unfamiliar ingredients in plant-based dairy, as these leave products open to being perceived as unnatural. The focus will be on making natural, plant-based ingredients more functional and nutritious, without the excessive use of additives.

Private label grows as consumers seek affordability

With global inflation decreasing in 2024 but remaining historically high, volume growth for dairy products and alternatives is expected to reach a modest 0.4% for the full year. In markets like the US, high unit prices have impacted the industry, and while retail value sales have risen in 2024, retail volumes are expected to have stagnated or declined in many categories. As purchasing power has declined, private label has become more appealing to consumers.

The global value share of private label dairy and alternative sales rose from 12.8% in 2019 to 14.9% in 2024

While private label products are predominantly found in cow’s milk across all regions, private label is expanding into more categories, improving in quality and introducing premium options.

Dairy players and consumers respond to sustainability concerns

Euromonitor’s Voice of the Consumer: Sustainability Survey, fielded January to February 2024, shows that nearly two thirds of consumers globally are trying to have a positive environmental impact through their everyday actions, due to concerns about climate change, and almost 60% believe they can make a difference. When buying food, consumers increasingly seek natural and locally-sourced products, which are seen as more sustainable due to reduced farm-to-fork miles, fresher taste, and their support for local economies. In addition, growing concerns about climate change and animal welfare are driving demand for more sustainable production practices, including lower emissions, reduced waste, diversified sourcing, and eco-friendly packaging.