Key performance indicators highlight the strong productivity of the U.S. dairy industry. According to Lucas Blaustein, Agricultural Attaché at the U.S. Embassy, who spoke during the AqAltyn 2024 event, U.S. cheese exports continue to grow. In 2024, they increased by 17% compared to 2023.

Trends and Insights from the U.S. Dairy Industry

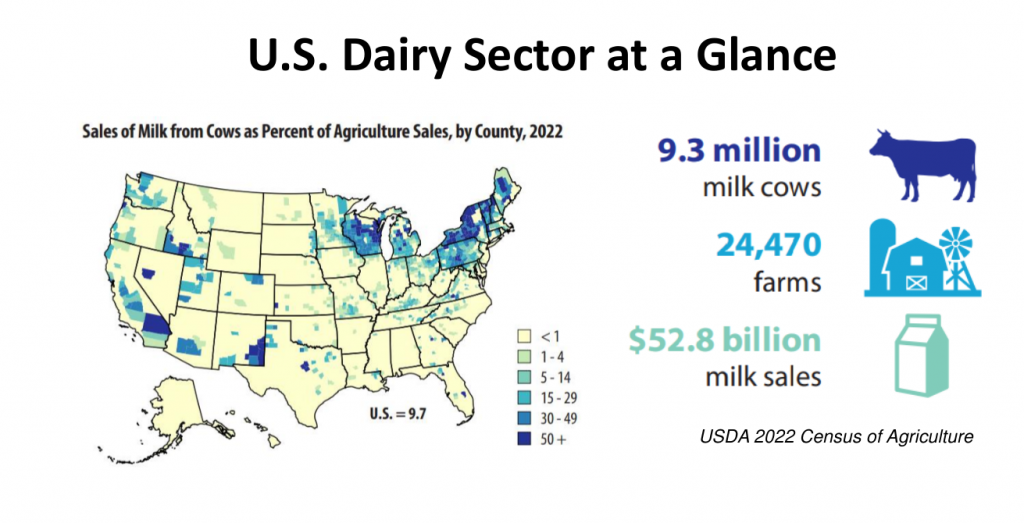

Blaustein noted that the number of dairy farms in the U.S. decreased by 40% from 2017 to 2022. Despite a reduction in herd size, productivity per cow continues to improve.

“Is there a single factor driving herd size reduction? Yes, it’s good genetics. Farmers in the U.S. have shifted from buying cattle to using sexed semen and adding heifers to herds. Technology is transforming how we manage dairy farming in the U.S.,” Blaustein explained. “Meat prices at the producer level (not retail prices, which rose by 40%) have significantly decreased, contributing to a reduction in overall livestock numbers. One of the drivers is the use of sexed semen,” he added.

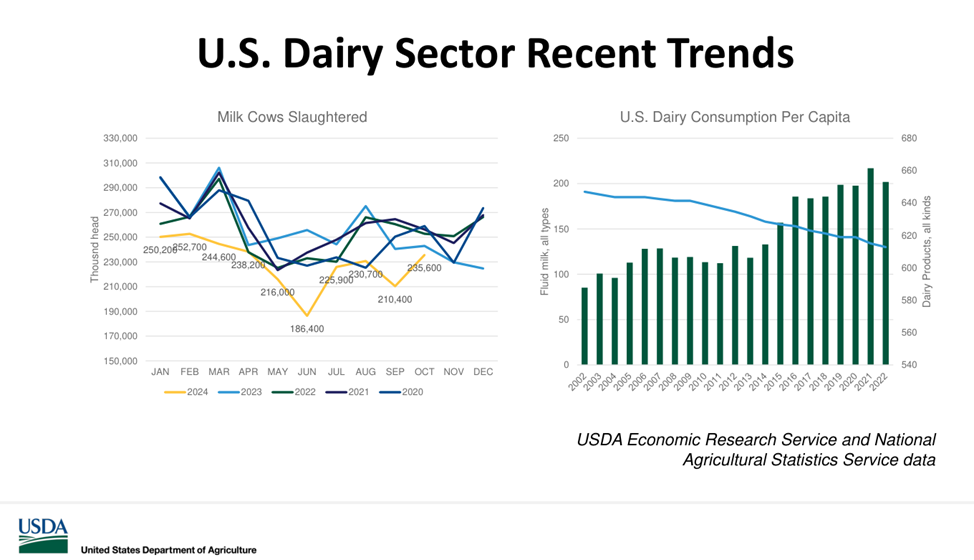

“For 20 years, Americans have been consuming less liquid milk. While we drink less milk, we consume more dairy products. This shift has also influenced the types of cows being raised, particularly with the rise of Jersey cattle,” he commented.

The industry faces challenges such as declining domestic liquid milk consumption. However, there is growing demand for processed dairy products like cheese and powdered milk.

“If we look at milk prices in the U.S., post-COVID saw a peak when everything became more expensive. Americans drank more milk and consumed more yogurt and cheese. Prices continued rising, with an oversupply of products in stores. Then prices fell, and now we are seeing market recovery, which has made farms more profitable since 2023,” Blaustein remarked.

U.S. Dairy Export Trends in 2024

According to USDA projections, notable changes in U.S. dairy exports are expected in 2024:

- Butter exports: Projected at 37,000 tons (+3% from 2023), but significantly lower than 2022 (68,000 tons).

- Cheese exports: Expected to reach 507,000 tons (+17% from 2023), marking the highest level in recent years.

- Whole milk powder exports: Anticipated to grow by 12% to 29,000 tons in 2024 (26,000 tons in 2023).

- Liquid milk exports: Forecast to rise by 7% to 144,000 tons in 2024 (135,000 tons in 2023).

- Skim milk powder exports: Expected to decline by 8%, totaling 742,000 tons in 2024 (809,000 tons in 2023).

Key Developments in the U.S. Dairy Sector

- Growth in Global Exports: U.S. dairy products remain competitive globally, with stable growth in exports.

- Price Stabilization: After two years of volatility due to COVID-19, dairy prices are returning to normal levels.

- Shifts in Consumer Preferences: Americans are drinking less milk but consuming more dairy products such as cheese and yogurt.

- Record Meat Prices: Supply chain disruptions during the pandemic caused meat prices to surge. However, low farmgate prices limited farmers’ benefits.

- Decline in Cattle Herd Size: Livestock numbers have reached their lowest level in 73 years due to various factors, including genetic selection and sexed semen use.

- Rising Costs for Herd Replacement: Smaller herds have driven up the cost of acquiring new animals.

- Decrease in Dairy Farms: The number of farms is decreasing, but the total number of dairy cows remains stable.

- Improved Productivity: Farmers are producing more milk with the same number of cows, reflecting increased efficiency.

The U.S. dairy industry is adapting to evolving consumer trends, technological advancements, and global market demands while addressing challenges like herd reduction and shifts in product consumption.

If you want share any News related Agriculture with us than send at info@agrimoon.com with your contact detail.