U.S. Dairy Markets — December 24, 2025: As the holiday rush fades, U.S. dairy markets are entering a post-festive lull, with traders and processors alike searching for signals on the next price direction for butter, cheese and cream. After a year of uneven momentum and a long-awaited return of official data from the U.S. Department of Agriculture (USDA), the industry is bracing for winter’s uncertainties.

Data Drought Leaves Markets Guessing

The dairy complex typically enjoys robust pre-holiday demand — driven by baking, entertaining and festive menus — which pulls supplies and supports prices for butter and cheese. But this year’s post-holiday backdrop is complicated by a data vacuum. A partial federal shutdown delayed USDA’s regular cold storage reports, depriving the market of fresh insights into inventory levels at a time when stocks and production trends matter most.

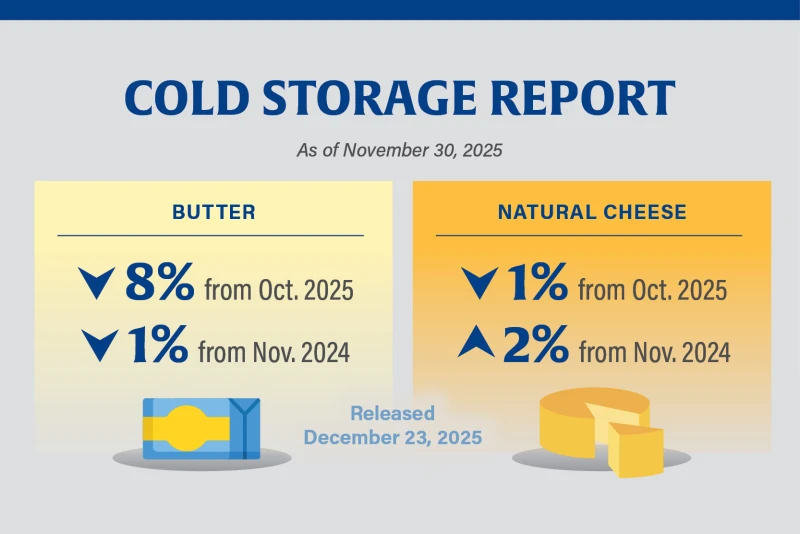

On Dec. 23, USDA finally released its first cold storage report since September’s August figures. While the age of that data — now four months old — limits its immediate clarity, it remains the best near-term snapshot of stock levels still available.

What the Last Cold Storage Report Showed

- Cheese inventories (August): Slightly down from the prior report but still higher year-over-year

- Butter stocks:

- 8% lower month-to-month

- 6% lower year-over-year

Those figures triggered a temporary rally in butter prices following the September report, but the broader market trend — set by summer highs — has been downward with periodic bumps.

Milk Production Signals a Seasonal Shift

The USDA’s November milk production report (released Dec. 22) showed:

- 18,790 million pounds produced

- Up 4.5% vs. November 2024

However, a key point often overlooked is the month-to-month drop:

- November: 665 million pounds less than October

- 3.4% contraction in one month

- Lowest monthly output since February 2025

While a winter dip in milk output is normal, the steeper than usual decline raises questions about whether milk production will continue sliding into late winter — a factor that could tighten supply further if it persists.

Read More: MP CM Sees Dairy Sector as Engine for Jobs, Industry and Rural Growth

Supply, Demand and the Cream Component

- Plants are operating at full capacity, buoyed by ample cream availability

- But with the peak baking and hospitality season behind us, production pressure may ease

- Cream stocks have been plentiful, supporting retail demand

- This has been counterbalanced by weak food-service usage, keeping overall demand flat

Where Does the Market Stand Now?

Traders have mixed views about current inventory on hand. The combination of:

- Seasonal milk production decline

- Higher year-over-year output

- Limited cold storage insight

- Balanced cream availability

- Seasonal shifts in consumption patterns

creates a morass of conflicting price signals.

If the latest cold storage data — old as it is — points to relatively low stocks for butter and cheese, especially alongside continued seasonal production declines, that might be enough to ignite a price rally in early 2026. But that possibility remains speculative, and not all analysts see it as imminent.

Key Takeaways

- New data arrival matters — USDA’s return to publishing cold storage numbers provides the market something to work with.

- Milk production seasonal decline (3.4% in one month) could tighten supply if it continues into winter.

- Butter and cheese stocks showed erosion in August, but the age of that data limits its predictive power.

- Retail demand boosted cream usage, but sluggish food-service demand tempers optimism.

- Production remains above 2024 levels, despite recent monthly decline.

Bottom Line

Dairy markets are in a winter lull, not a collapse. The latest government data gives buyers and sellers a partial map in a fog of uncertainty, but supply and demand fundamentals remain in flux.

If inventories are indeed low and production continues to fall, prices could find support in early 2026 — but the signal is far from confirmed. For now, traders will watch monthly production reports, updated cold storage figures, and demand patterns closely, hoping the next data drop provides firmer footing for prices in butter, cheese, and cream.

Join Our “Dairy & Food Jobs Updates” WhatsApp group

Disclaimer

I do my best to share reliable and well-researched insights but occasional errors or omissions may slip through. Please view all content as informational.

Stay informed on all the latest news updates

All Agriculture Books Free Download

All Dairy Technology Books Free Download

All Agricultural Engineering Books Free download

All Horticulture Books Free Download

All Fisheries Science Books Free Download

For Daily Update follow us at:

Facebook Telegram Whatsapp Instagram YouTube

The contents are provided free for noncommercial purpose such as teaching, training, research, extension and self learning.

If you are facing any Problem than fill form Contact Us

If you want share any article related Agriculture with us than send at info@agrimoon.com with your contact detail.