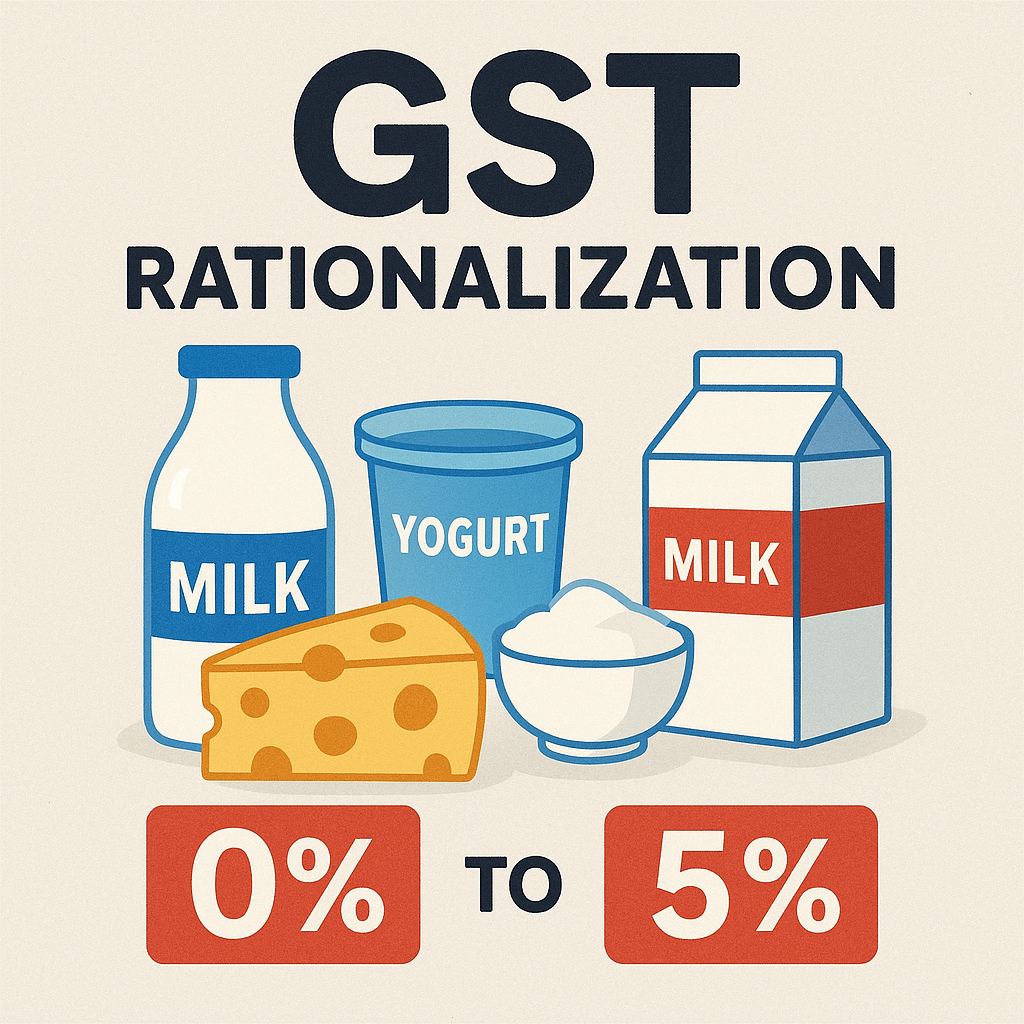

In a move to support India’s dairy sector, the 56th GST Council on Wednesday approved a rationalization of GST rates on milk and milk products. Under the new structure, which will take effect from September 22, most dairy items are now either exempt from tax or subject to a 5 per cent rate.

Ultra‑High Temperature (UHT) milk and pre-packaged paneer or chhena will now attract no GST. Butter, ghee, dairy spreads, cheese, condensed milk, milk-based beverages, ice cream, and milk cans have seen GST reduced to 5 per cent from earlier rates ranging between 5 and 18 per cent.

Read More: Get more News from Dairy Sector

The tax rationalization is expected to benefit rural farmer families, particularly small and marginal farmers involved in milk production, while also providing relief to consumers. Lower GST rates may help reduce costs for producers and improve competitiveness of Indian dairy products in domestic and international markets.

India is the largest milk producer in the world, with an output of 239 million tonnes in 2023–24, accounting for nearly a quarter of global production. The dairy industry contributes about 5.5 per cent to the national economy, and the value of milk output reached ₹12.21 lakh crore in 2023–24. The overall market size of the sector is estimated at ₹18.98 lakh crore in 2024.

Join Our “Dairy & Food Jobs Updates” WhatsApp group

Stay informed on all the latest news updates

All Agriculture Books Free Download

All Dairy Technology Books Free Download

All Agricultural Engineering Books Free download

All Horticulture Books Free Download

All Fisheries Science Books Free Download

For Daily Update follow us at:

Facebook Telegram Whatsapp Instagram YouTube

The contents are provided free for noncommercial purpose such as teaching, training, research, extension and self learning.

If you are facing any Problem than fill form Contact Us

If you want share any article related Agriculture with us than send at info@agrimoon.com with your contact detail.